With it, you can make your own predictions about what the future will bring and make a decision accordingly. Savings bonds earn compound interest until they reach maturity. Then from time-to-time, you may tweak the numbers and rerun your break-even analysis. If you enter your average income per day, then the BEP is the number of days you must drive to break even. On the other hand, you may decide to enter your average income per day, and then your BEP will be the number of days you need to drive. The only national organization that pro-actively helps you grow your business and your bottom line.

Premium Investing Services

By reaching this number of unit sales, the company has not gained profits yet. Once Company A sells over 500,000 units, that’s when it will earn profits. Our guide will discuss the fundamentals of the break even point and how to calculate this financial benchmark. We’ll talk about different factors that impact breaking even, such as fixed and variable costs. We’ll also discuss how these factors affect unit selling price. Then, we’ll touch on strategies to reduce business costs, as well as different ways you can increase your sales.

- The break-even point (BEP) helps businesses with pricing decisions, sales forecasting, cost management, and growth strategies.

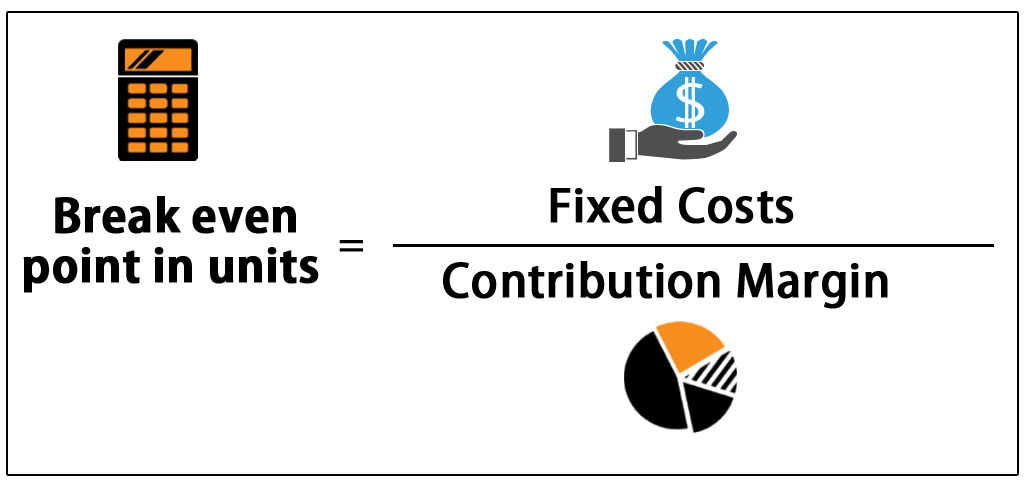

- With the contribution margin calculation, a business can determine the break-even point and where it can begin earning a profit.

- The latter is a similar calculation, but it’s based around knowing how much you bring in over a certain period of time.

Break-Even Point in Units

It helps you figure out how many units you need to sell or services you need to provide to make sure your investment pays off. Break-even analysis is great for entrepreneurs or companies that are just starting out and unsure of what to sell, how much to sell, or where to allocate their budget. This simple analysis can help that decision-making process by determining how much product you’ll need to sell to be profitable and how long that product will last. You can adjust variables, fixed costs, sales price, and volume metrics in each analysis to determine how much to budget for each of those costs.

Component Costs

Our online calculators, converters, randomizers, and content are provided “as is”, free of charge, and without any warranty or guarantee. Each tool is carefully developed and rigorously tested, and our content is well-sourced, but despite our best effort it is possible they contain errors. We are not to be held responsible for any resulting damages from proper or improper use of the service. This is a step further from the base calculations, but having done the math on BEP beforehand, you can easily move on to more complex estimates. We use the formulas for number of units, revenue, margin, and markup in our break-even calculator which conveniently computes them for you.

Investment

If you are an Uber driver and you enter for the selling price per unit the average price per trip, then your BEP is the number of trips you must make. If you get this loan option from a bank, expect them to require strong revenue and several years of business finances to qualify. If you need a larger line of credit, the bank will likely require collateral for finances.

Net Profit Margin Calculator

You can hold weekend markets or other holiday-driven events to boost sales. Small and new businesses tend to find it more challenging to maintain an inventory. It takes time before they learn how much stocks to carry, all while sustaining a level of customer satisfaction. Inventory management for small startups can easily end up in costly storage and inventory insurance expenses.

On top of this, what if you have a startup loan you need to repay? Let’s say you have a $20,000 commercial loan that you want to pay off in two years. To do this, you must put an additional $10 per unit if you intend to sell 2,000 products in two years. Thus, your BEP selling point will be $25 per product during the first two years. Suppose your overhead expense is $10 per product, which is $100,000 for 1,000 units. If you generate and sell 1,000 products, your total BEP would be $15,000, which is $15 per product.

It’s also more cost-effective to share restrooms and dining areas with neighboring offices when you’re looking for a professional space. If you intend to sell new products, calculating the BPE allows you to price your product strategically. Having a successful business can be easier and more achievable when you have this information. It makes the difference from operating at a loss to achieving financial goals and expanding production. Where the contribution margin ratio is equal to the contribution margin divided by the revenue.

Break-even analysis is an important way to help calculate the risks involved in your endeavor and determine whether they’re worthwhile before you invest in the process. If you find yourself asking these questions, it’s time to perform break-even analysis. Read on to learn all about how break-even analysis can serve your small business. Divide 1.03 by 1.01, and subtract one, and the break-even rate of 1.98% accountant and bookkeeper stories represents the average annual inflation rate that would leave the two bonds equal at maturity. The other typical situation involves comparing a traditional bond with a bond with the same maturity date whose principal value automatically adjusts for inflation. In this case, you’re calculating the break-even interest rate of inflation for which buying the inflation-indexed bond will provide a larger return.

If you can find a supplier with a good deal on raw materials, it can also lower your BPE. Achieving a competitive price and upgrading the quality of your product will also boost sales, therefore reducing BPE. It’s a useful reference point that helps strategically price your products. The break-even point is the sales level at which total revenues equal total costs, meaning the business neither makes a profit nor incurs a loss.

It’s also important to check your competitor’s prices and any unique features to their products. But if the market allows it, you can certainly increase your price up to a level that consumers will keep buying. Based on the example, when your loan is paid after three years, if all variables remain the same, you can reduce your price to $15 per unit for more competitive pricing. On the other hand, you can keep the same price ($20), which allow you to make more profits per unit.